How to Invest in Tax Deeds in Florida: A Beginner’s Guide to Building Wealth

If you’re seeking an innovative and strategic method to build wealth through real estate, Florida tax deed investing could be

Sandra is happy to share the wealth of knowledge and information she has, and continues to learn every day, to help grow your business.

If you’re seeking an innovative and strategic method to build wealth through real estate, Florida tax deed investing could be

Exciting news is sweeping through Central Florida. Seminole County, one of the last holdouts for in-person tax deed auctions in

By: Sandra M. Edmond If you’re an investor looking for lucrative opportunities in real estate, tax lien certificate auctions in

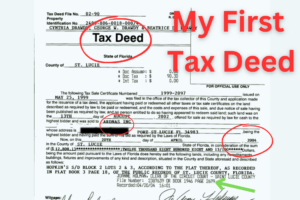

It’s been 20 years and I am so grateful to have made it a success in real estate this long.

As March 31st passed, it’s not too late… property taxes and assessments are due. You will still pay a late

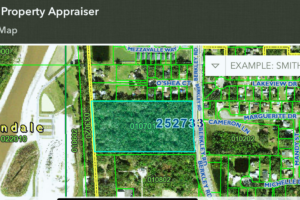

This Auburndale, FL property on Berkley Rd is zoned Commercial / Industrial. It’s 332 ft wide by 1,115 ft deep

If you or someone you know is facing difficulties in managing your property taxes, consider reaching out to your county

Next time you get your property tax bill you will want to make sure to not only verify your name

Florida is the latest among states to pass laws to help homeowners eject squatters. FL Governor Ron DeSantis signed a

Tax deed investing gives investors a unique opportunity to buy properties at a fraction of their market value. With the

Are you looking for a low-risk way to earn higher returns than what your bank has to offer? Tax liens

When was the last time you worked 3.5 hours and made over $2,000 per hour? People who know how to

When you own your own business, sometimes driving 2 hours is just something you have to do. You go where

“Oh my gosh, how do you do that?” “Aren’t you scared to buy those things?” Those are just a few

Here is a quick tutorial video on how to run comps when you don’t have access to MLS or don’t

Subscribe to the newsletter and get free County Links Spreadsheet

Get registered for one of Sandra’s events today because spots are limited and they fill up fast.

Click on the event title to visit the registration page.

TBD 7:00p-8:00p (EST)

Apr 22-23, 2025 Orlando 9:30a-5:30p (EST)

Starts weekly online Apr 30, 2025 7:00p (EST)