It’s been 20 years and I am so grateful to have made it a success in real estate this long. Back in March 2004 ✨ ARDNAS, Inc. was incorporated after I changed the name of a corporation I had opened a couple of months earlier. We thought we wanted to go into the assisted living business but we soon changed our minds. Instead of scrapping the corporation that was started in Dec 2003, I changed the name to ARDNAS, Inc. in March 2004. I decided to use my first name, Sandra, backward as the name of the corporation. Why not it worked for Oprah with her HARPO! Since then we’ve weathered the best of times and worst of times. I started out wholesaling real estate and it came easy to me. I had been a television reporter before that so it was easy now to knock on people’s doors to offer them money (for their homes).

When I was on TV I usually met people on the worst or best day of their lives and asked them to speak about it… not always easy. Not to mention it was emotionally draining some days. Transitioning to real estate was great because I could set my schedule and the financial freedom was excellent. We’ve been through times of abundance and times of struggle (2008 recession). Along the way, I have met some great people and organizations. I’ve helped not only investors succeed by teaching them to skills necessary to start and prosper but I’ve also helped out a lot of homeowners in a tough place. I’ve found integrity and always doing what you say to be some of my most successful guiding principles.

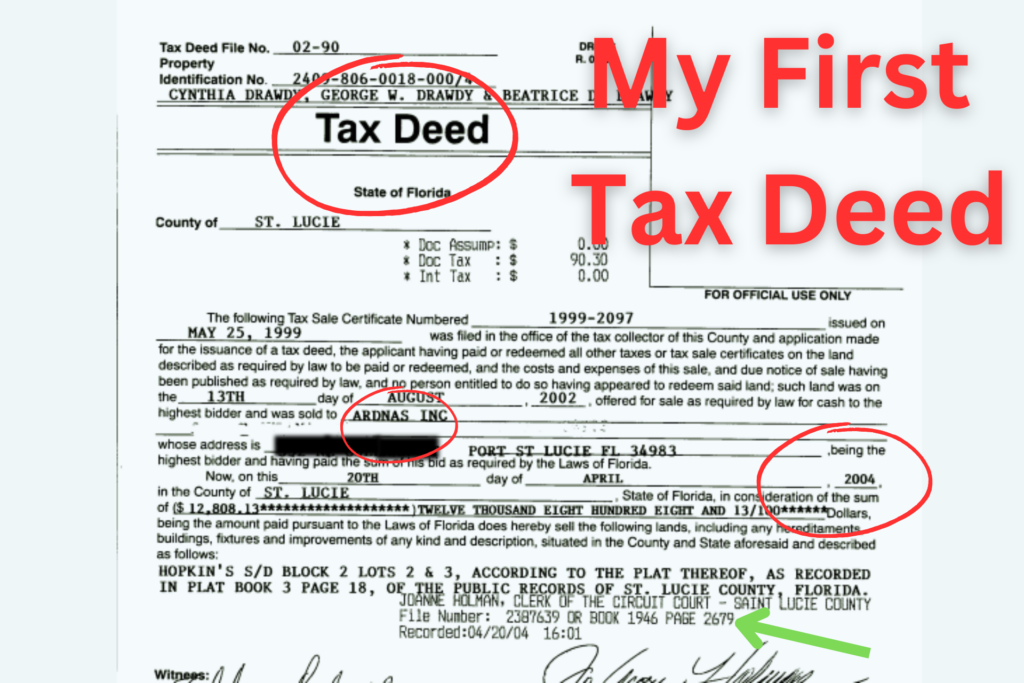

This picture is my first tax deed ever. It is for 1215 Orange Ave in Ft. Pierce, FL. The property was under 1/2 an acre vacant lot. There had been a building on it that code enforcement demolished. As you can see we paid $12, 800.13 for it. We sold it a few months later for $47,000. In the past 20 years, I’ve done so many different types of transactions and learned a ton from wholesaling, tax deeds, tax liens, probates, foreclosures, adverse possession, rentals, sold with owner financing, bought with owner financing, lease options, representing sellers and buyers as an agent and broker, vacant land, sold notes, tax sale surplus, numerous types of motivated seller situations and so many more that I’ve probably forgotten to name here.

That first tax deed on Orange Avenue came off of the lands available list. Lands available include houses, land, mobile homes, duplexes, condos, townhouses and just about any type of real estate. Just because it’s called ‘lands available’ doesn’t mean it’s only land. When a property is auctioned off at the tax sale and no one bids on it the county offers it to the tax lien certificate holder. If the certificate holder doesn’t want the county puts it on the lands available list after 90 days. Anybody can purchase it off the lands available for just the back taxes.

I still remember how scared I was doing my first wholesale deals and tax deeds in 2004. Even though I was scared I did it anyway. You will never know EVERYTHING even if you digest all of YouTube and what’s on the internet. At some point, you have to pull the trigger and take action. I’ve been in the shoes of the newbee, the intermediate and the expert so I keep that in mind when I teach investors how to do it. My best advice —- DO IT SCARED. One of my favorite quotes says ‘You can’t steal 2nd base if you keep your foot on first.’ I also credit my faith in God, our savior Jesus Christ. Trust I’ve had to pray myself through many deals. It also took courage, tenacity and my mom who encouraged me to do that first tax deed deal on Orange Ave 20 years ago.

Ready to see why so many of the investors I teach are so successful, join my live event the 2 Day Tax Deed Field Trip Experience or learn online at your own pace with my Tax Deeds at Your Fingerprints course. Use this coupon code for our special 20th anniversary pricing of 20% off: 20YEARSARDNAS