Tax deed investing gives investors a unique opportunity to buy properties at a fraction of their market value. With the potential to make a ton of money, tax deed investing is an attractive option for savvy real estate investors.

In this blog post, I’ll share 5 essential tips to help you maximize your profits when investing in tax deeds.

1. Understand the Basics of Tax Deeds

Pump your brakes! Before you jump into tax deed investing, it’s very important that you understand the basics. Tax deed investing involves buying properties at county auctions to recoup unpaid property taxes. You can purchase them at a fraction of their value, giving you the potential for a significant return on your investment. However, it’s essential to know the ins and outs of the process. You should also be familiar with the laws regarding delinquent property taxes. These laws vary from state to state and sometimes between different counties. For example tax deed auction in Florida require a 5% deposit when you win and the balance is due the same day or within 24 hours.

2. Do Your Due Diligence

Before bidding at the tax deed sale, make sure to do your due diligence. Research the property including its location, fair market value, condition, and look up liens or mortgages on the property. Also do research on the market to come up with the ‘days on market’ to sell. By doing some of this research, you’ll be better prepared to make informed decisions, avoid mistakes and make a good chunk of money.

3. Set a Budget and Stick to your Budget

When your bidding at the tax deed sale it’s so easy to get caught up in the excitement and bid too high. This is what you need to set a budget based on the research you did above. I like to set a range when I set my budget or as I call it my maximum allowable bid (MAB). By sticking to your MAB or budget, you’ll avoid paying too much so you can make a great profit.

4. Be Prepared for the Ooops in your Expenses and Budget

Anytime you are buying a tax deed you can expect the property will not be in it’s highest and best condition. Most properties will need repairs to get top of the market prices. Always factor in mistakes you might make in estimating repairs and add in 10% for miscellaneous… the oops I missed that costs.

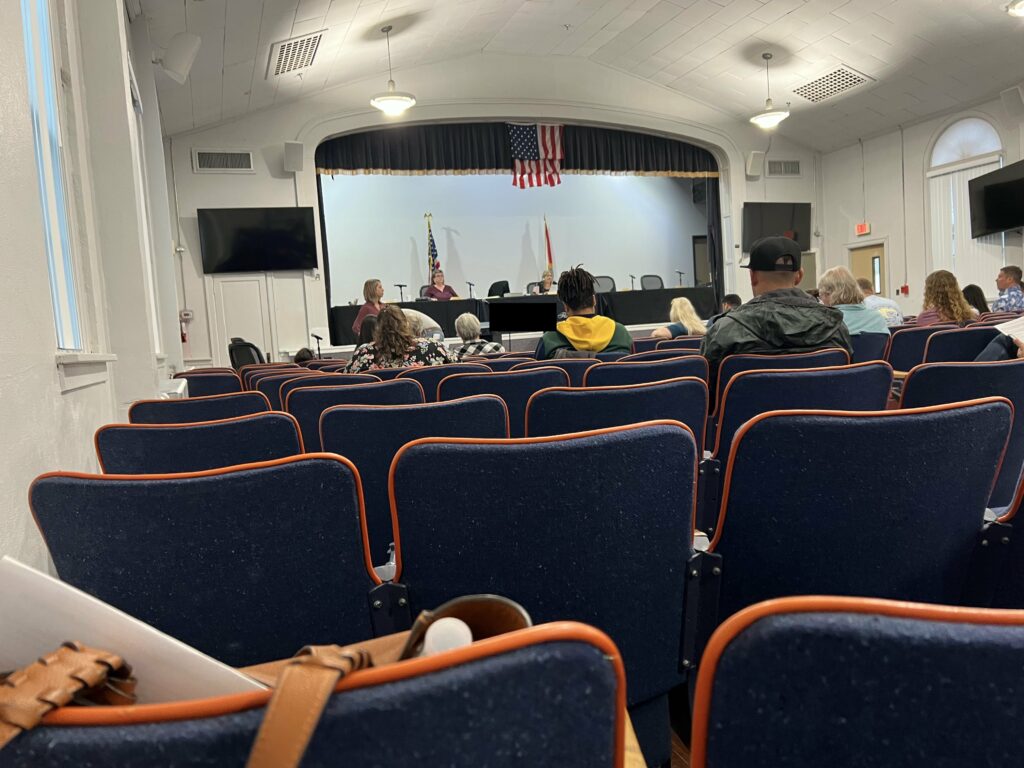

5. Join your Local Real Estate Investors’ Association

Tax deed investing can be pretty competitive but you can make friends with other bidders, investors and real estate professionals like real estate agents. Real Estate Investor Associations (REIAs) allow you to network with like minded individuals who can help you overcome hurdles. Attend local investor meetings, register for my tax deed & lien webinars and subscribe to my youtube channel which is dedicated to tax deed investing.

By following these 5 essential tips for investing in tax deeds, you’ll be able to maximize your profits. You’ll also build your wealth through tax deed investing. Remember these steps. Understand the basics. Do your due diligence. Aways set a budget. Prepare for the ooops expenses. And network with other investors to make the most of this lucrative investment opportunity.